Ohio Aviation Association Political Action Committee

What is the OAA PAC?

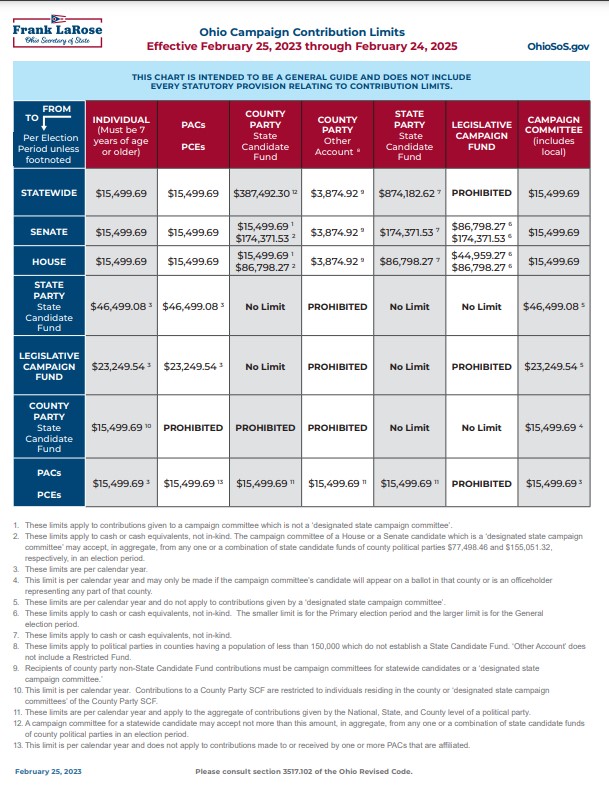

The Ohio Aviation Association Political Action Committee (OAA PAC) is a political action committee of the OAA under section 3517.082 and 3517.01 C 8 of the Revised Code. The OAA PAC is not affiliated with any political party and is organized for the purpose of receiving voluntary contributions from employees of member organizations, other political action committees, or separate segregated funds and to raise funds to contribute to candidates, ballot measures, and political committees that support and promote aviation. The OAA PAC is not a federal PAC. The Ohio Aviation Association provides minimal administrative support to the OAA PAC.

OAA PAC: Ohio Airports' Partner for Success!Read more here to learn how the OAA PAC is your partner for success! How Can I Contribute?If you are an individual, another PAC, sole proprietor, partnership, or association, formed under the State of Ohio, you can contribute by:

OAA PAC Donation ($50 minimum) Donate

Except for PAC to PAC contributions, the OAA PAC must keep on file the contributor's name, address, and occupation. For any contribution over $25, this information is reported to the State of Ohio. Incorporated professional associations and limited liability companies are considered unincorporated associations or, if applicable, partnerships; which are permitted to make contributions. However, the partnership may not make a contribution in the name of the partnership alone. At the time the entity issues a contribution check, it must also provide OAA PAC details on how the check is to be allocated among the partner/s, owner/s, or member/s making the contribution. [R.C. 3517.10 (I)]. Further, if the allocation is not provided from such an entity, OAA PAC cannot accept the contribution. Interested in joining us for an event? Upcoming OAA PAC events:

|